Switzerland’s national postal service is targeting one million Swiss residents to join its ePost encrypted communications service by the end of 2025.

Swiss Post, faced with the prospect of annual falls in demand for traditional postal services, is betting that its ePost mobile app will fill the gap left by the declining use of traditional mail.

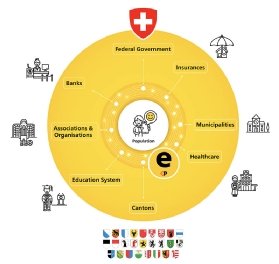

ePost aims to become the go-to app in Switzerland for people to communicate with banks, insurance companies, government, hospitals and other organisations such as clubs and societies.

It offers Swiss citizens a single inbox for email, instant messaging and electronic post, the ability to receive and pay bills, and the facility to store and access documents, ranging from insurance quotes to medical records.

The app, which claims to be the first of its kind, has attracted interest from governments and postal services in Germany, France and the Nordics, which are investigating the potential to build equivalent apps.

Renato Stalder, CEO of ePost, told Computer Weekly that demand for the app has grown throughout 2024, with 15,000 to 25,000 people signing up each month, often through word-of-mouth recommendations.

The decline of postal services

The need for a digital alternative became clear to Swiss Post in 2000 when the volume of letters posted in Switzerland began a rapid downward trajectory as people replaced letters with emails and text messages.

The use of traditional postal services is declining rapidly

The use of traditional postal services is declining rapidly

With Swiss Post’s revenues in decline, the government decided the country should build a nationwide communications platform that would be available to everyone living in Switzerland or overseas with a Swiss passport.

Swiss Post created a subsidiary, ePost Service AG, to develop the technology. It was intended to act more like a startup company than a traditional postal service, with the ability to move quickly and attract talented technology experts.

Stalder told Computer Weekly that, to secure financial backing, the new company had to find a niche that had yet to be exploited by other communications services.

The market for business-to-business communications had already been cornered by Microsoft technology, particularly Microsoft Teams, while WhatsApp was the app of choice for people to send personal instant messages.

But ePost identified a gap in the market for technology that would help businesses and government agencies communicate with consumers and citizens.

ePost’s breakthrough idea was to build an app through which Swiss citizens could communicate with multiple business and government departments, pay bills, sign contracts, and collate important documents and communications.

“We said let’s bring together people, organisations, Cantons [administrative districts], banks and insurance companies on one distributed platform to allow secure communications, and let’s create that as a piece of national infrastructure,” said Stalder.

The company turned to the open source protocol, Matrix, which offers decentralised secure communications.

The technology has the advantage of not tying its users to proprietary messaging services, such as WhatsApp, or requiring companies that deploy Matrix messaging services to be locked into the technology of a single provider.

Its interoperable design means it is possible to send messages on the Matrix protocol and have them delivered through “bridges” to other messaging services.

Digital post

Swiss Post began developing its country-wide communications platform in October 2020 and the app was ready to roll out in July 2021. The main selling point was to offer a digital alternative to paper post.

The ePost app offers secure mail, digital post and secure storage

The ePost app offers secure mail, digital post and secure storage

The business model was influenced by the postal service – the sender pays, but the app is free to use for the public.

It was not successful, said Stalder. “We made a big mistake. We were so focused on the history of post that we were thinking about letters and decided to digitise the letter,” he said.

Stalder acknowledged that ePost had failed to recognise the public’s changing preferences. The growth of email and instant messaging meant that letters, even in digital form, were in decline.

It took six months to convince the first 50,000 people to download the app. The app simply did not offer enough benefits to persuade people to use it, said Stalder, and businesses were not keen to add digital post as yet another communications channel.

Back to the drawing board

ePost went back to the drawing board to develop an updated version of the app featuring secure messaging and email, document storage, digital document signing and a simple way to pay bills.

The service offered small and medium-sized companies cloud-based software that they could use to manage their relationship with customers. For larger companies, there is an on-site server.

When the updated app became available in 2024, persuading companies and Swiss citizens to sign up to the app nevertheless proved to be “a chicken and egg problem”.

Companies did not want to sign up unless they could use the app to reach a significant number of people, and citizens were not interested unless they could use the app to reach a significant number of companies and government organisations.

The upside was that the first company to solve the problem would have a monopoly. As Stalder said: “It’s a winner-takes-all approach.”

The lure of branding

Stalder’s initial goal was to sign up two banks, two insurance companies and two regional government Cantons.

The app aimed to attract businesses by offering them branding that mimics the branding they would have had on physical letters, including a company colour scheme and logos.

It also offered a safe alternative for staff who might use non-work apps such as WhatsApp for official communications.

Stalder, who has also worked on the governance committee of a bank, found there were concerns in financial organisations about employees using WhatsApp and similar messaging services.

ePost links citizens to banks, insurers, schools, health care, clubs and associations

ePost links citizens to banks, insurers, schools, health care, clubs and associations

Although WhatsApp is end-to-end encrypted, and therefore secure, the difficulty is that WhatsApp messages are not recorded in company records. That means, for example, if a customer accused a bank of providing bad financial advice over WhatsApp, the bank would have no record of the communication.

These features have proved attractive to businesses. “We say we want to give the same comfort and convenience [as WhatsApp] but without the problems. And that’s where the corporates react very positively,” said Stalder.

Benefits for customers

Users benefit by being able to use a single app to communicate with a wide range of businesses, clubs and government services. They can receive invoices, contracts and other digital documents, emails, SMS messages and secure emails, which appear in one inbox.

People can also pay their bills from the app, which can connect to their bank through an open banking standard used by 70% of Swiss banks. The app will also recognise contracts and allows people to sign them digitally.

“You get sent a bill and you have one click to send it to your e-banking. This is the most used function. The second most used function is signing papers directly in the app instead of printing them out,” said Stalder.

Finding documents

As all messages appear in one inbox, people do not have to spend time searching their emails, text messages and paper files to find information.

The app also allows users to tag documents – for example, to identify documents and receipts, which saves time when filing an annual tax return. At the end of the tax year, people can ask the app for all the receipts needed to complete their tax declaration.

“Every document that comes in gets a digital signature at the moment it comes into the system. And we can guarantee, since it’s in the system, it was never changed,” said Stalder.

Next steps

For now, ePost – which employs 140 people, most of whom work on development – is focused on growth. It has set the ambitious target of reaching one million users by 2025 and is set to break even by 2026.

The next step is to add secure encrypted email, which will appear in the same inbox as regular email, chat messages and digital letters.

ePost is focused on growth and has set the ambitious target of reaching one million users by 2025

ePost is focused on growth and has set the ambitious target of reaching one million users by 2025

“We want to have a unified communications approach. As a user, I don’t care if it was an email going ping-pong or a text message. That is the thing we are working on now,” said Stalder.

Over the next two years, ePost also plans to develop ways to make it easier to integrate other software applications into the platform by developing application programming interfaces (APIs). One plan is to link ePost to Microsoft Teams so that people working for corporations or the government can speak to customers through their ePost app on their mobile phone.

There are still technical challenges ahead. One issue is that people can miss messages if they log out of the app, such as when they change their mobile phone. At a Matrix conference in Berlin this year, other organisations revealed they had experienced the same problem.

“I have learned that everyone has this problem, so it’s a real issue, but the good thing is that the pressure is so high, I am sure it will be solved,” said Stalder.

Lessons learned

If there is one thing Stalder would do differently, it is to start with email and messaging services rather than trying to replicate letters electronically.

“Sometimes I go with our commercial people and to see the reaction of the client when we present them with new functionalities,” he said. “When we start our story with the digital letter, you can see they are sitting there and saying, ‘Okay, that’s nice’. But when we talk about new channels, they open their eyes and say, ‘Well, that would allow us to have a totally different conversation with the customer, why didn’t you tell us before?’.”